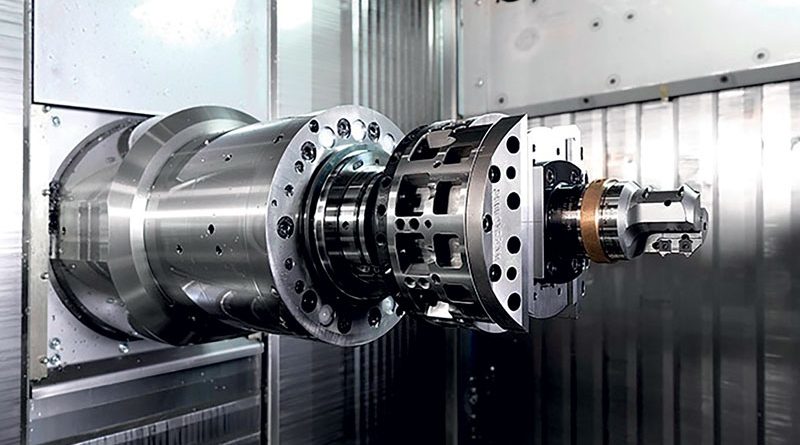

A Record Year for Italian Machine Tools, but What does the Future Hold for Us?

The positive curve that kicked off in 2014 has continued through to the end of 2018 for Italian machine tools, robots and automation system, represented by UCIMU-SISTEMI PER PRODURRE. This year will see, however, a slowing in production, exports and consumption. The association will be making a plea to the government for a long term Industry 4.0 plan that will be both structural in its scope and free of future uncertainty.

by Alma Castiglioni

Italian machine tools, robots and automation systems enjoyed its best ever year in 2018. Double digit growth was recorded across the sector, a continuation of the upward trend which began in 2014. The sector is the fourth biggest Italian producer, third in terms of export volumes and fifth for consumption. Proof of a buoyant domestic market that continued to reap the benefit of the Industry and enterprise 4.0 plan. 2019, however, will see the first drop off in five years. This will be due to internal and external instability. During the association assembly last June, Massimo Carboniero, UCIMU president, expressed his satisfaction with results but worries too concerning 2019’s murky outlook.

Consolidated results 2018: growth exceeding 11%

In 2018, production of machine tools, robots and automation systems had an overall value of €6.775bn. Growth of 11.3% on 2017. This was thanks to strong domestic demand (+15.2%) as well as exports which saw 8% expansion on the previous year. Germany (+15.1%) continues to be the main partner, followed by the US, China, Poland, France, Spain, Russia and Turkey. Consumption soared for the fourth successive year, again with double digit growth to reach €5.164bn, +15.7% on 2017.

Forecast for 2019: a slowdown in growth and consumption.

This year is expected to be one of levelling off in Italian industry. Lower overall production will be a key factor, growing by 3.6%. The same is true for exports, increasing by 6.5%, making up 55.6% of production. Consumption will also slow (1.1%), staying at 2018 levels as will domestic market deliveries (0.3%) and imports (2.3%).

Carboniero warns “Bearing in mind the highly unstable global political picture, we can consider ourselves lucky if these forecasts are met!”

Association proposals for industrial policy

Super valued trade-ins, the bed rock of the Industry 4.0 program certainly bore fruit in terms of obsolete machinery being replaced. Encouraging firms to go digital with inter-connected machinery. Carboniero maintains a new direction is now necessary: how this legislation is made available. “The days of intermittent programming are over. Sadly, this has all too often been the case until now. For Italian companies to continue to grow, they need long term clarity and planning. This will lead to investment and the steps to stay competitive. Carboniero asks a long term, 4.0 plan of the government that sweeps away the annual wait on measures to be re-confirmed. Training must take the same route. He also wishes to see tax credits for training reviewed as well as confirmed for 2020. l