Industry 4.0: market speeds up

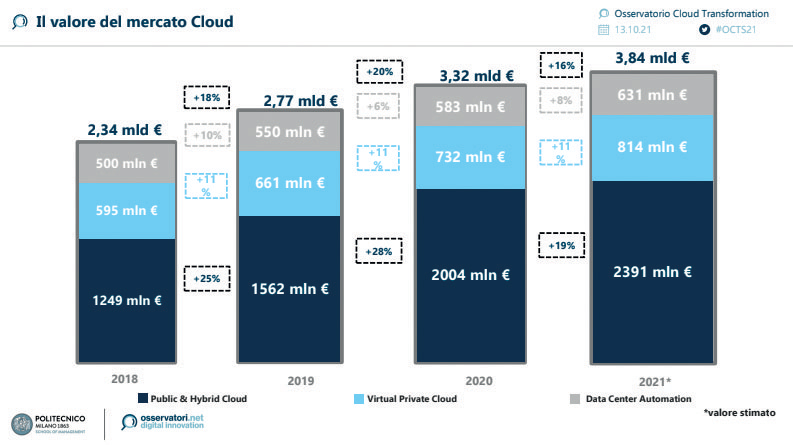

Driven by investments in Cloud Manufacturing (+25-30%) and Advanced Automation (+15-20%) in 2021 Industry 4.0 market will speed up compared to 2020 and is expected to exceed €4.5 billion (+12.5% compared to the previous year). This is what emerges from the Industry 4.0 Transition Observatory of the School of Management of Politecnico di Milano that was presented last month during an online conference.

The Italian Industry 4.0 market was worth €4.1 billion in 2020, with an 8% growth rate, mainly driven by IT technologies, which account for 85% of expenditure against 15% for OT (Operational Technologies). Manufacturing companies’ investments are mainly concentrated in connectivity and data acquisition projects (Industrial Internet of Things) and Industrial Analytics. The remaining spending on 4.0 solutions is distributed between Cloud Manufacturing, Consulting and Training Services, Advanced Automation, Additive Manufacturing and Advanced Human Machine Interface. Although lower compared to 2019 expectations, market growth was still very good. Forecasts for 2021 indicate a further spending acceleration, at a rate ranging between +12% and +15%. A value of over €4.5 billion is expected, driven in particular by Cloud Manufacturing (+25-30%), Advanced Automation (+15-20%) and Advanced HMI (+12-18%). These are the results of the research of the Industry 4.0 Transition Observatory of the School of Management of the Politecnico di Milano, presented last October during an online conference entitled “Industry 4.0 in a changing world”.

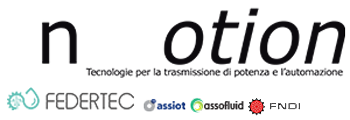

Companies have exploited the potential of over 1,400 Industry 4.0 applications

About 1,400 Industry 4.0 applications were used by manufacturing companies. The most popular are Industrial IoT solutions, often combined with Analytics and Artificial Intelligence algorithms. These are followed by Advanced HMI technologies, such as wearables and human-machine interfaces for acquiring and transmitting data in visual, vocal and tactile formats; Advanced Automation, i.e. automated production systems such as collaborative robots; Industrial Analytics, the fastest growing applications (200, +39%), focused on forecasting the performance of industrial assets and production processes; then Cloud Manufacturing applications, mainly used for remote monitoring and diagnostics of industrial plants; Additive Manufacturing, also known as 3D Printing and mainly used in the automotive and aerospace sectors.

According to Marco Taisch, Scientific Director of the Industry 4.0 Transition Observatory, “the simplest initiatives are now proven, with at least one project activated in 75% of manufacturing companies, whereas, in order to launch pervasive, multi-technology, cloud-based and innovative network digitisation projects, it will be necessary to have a long-term vision, the courage to experiment with new applications for the new challenges that have been created and a strong investment in 4.0 skills”.

“The year 2020 has encouraged companies to reconsider the way in which operations are managed,” commented Giovanni Miragliotta, Director of the Industry 4.0 Transition Observatory. The transformation of business models towards digitalisation has changed the approach with which value is transferred to the customer: remoteisation, flexibility and servitization (i.e. the concept of product as a service) are becoming the key elements in the management of the digital enterprise. The issue of supply chain resilience is now strategic in order to maintain and possibly increase the productivity of companies and their ability to adapt their offerings to the challenges and demands of the post-pandemic market”.

The National Plan Transition 4.0: companies are well informed

The opportunities offered by the National Transition 4.0 Plan are well known by manufacturing companies: 83% of the 175 large companies and SMEs surveyed by the Observatory are aware of the tax credit for investments in capital goods, 55% of the tax credit for research, development and innovation, and 52% of the tax credit for training. Companies would like it to be flanked by other forms of incentives to accompany market growth. In the next six months, the most felt needs are tax relief on factory operators to lower labour costs and incentives for hiring staff, while in the next two years companies would like above all the relaunch of forms of hyper and super depreciation on capital goods (purchase, revamping and accessories), and new incentives for investments in intangible assets (software and platforms for system integration).

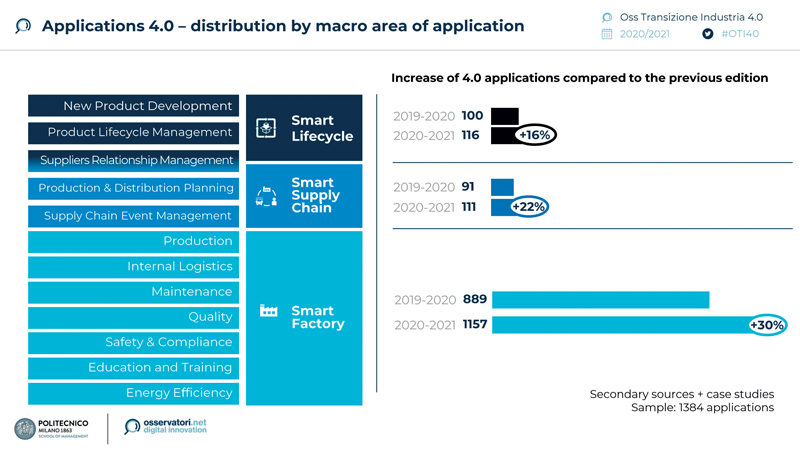

4.0 technologies for sustainability

Manufacturing companies are becoming increasingly aware of sustainability issues. The areas most concerned by the use of Smart Technologies for sustainability are consumption monitoring in operations management and end-of-life management.Companies mainly monitor indicators related to process waste, such as waste and pollutant emissions, consumption of water, materials and energy along the different stages of the production process, but a quarter of the companies surveyed still do not consider any performance indicators related to sustainability. The main barriers to using digital to improve sustainability are the lack of corporate culture, the lack of indicators linking sustainability performance to the value of a company and the difficulty in understanding the benefits that can be achieved.

Services 4.0: product as a service

While the value associated with operational consulting services is growing, strategic consulting is finding little room. Consultancy firms seem to have succeeded in transferring their activities to digital channels, thus greatly reducing the possible effects of the pandemic and opening up to a business model based on the provision of more sustainable products and services of value to the client (Servitization 4.0). The vast majority of companies are already familiar with the use of capital goods and software for a monthly or annual fee, but the opportunities offered by machine connectivity are still little exploited by companies.

Few companies are using information services associated with a machine, such as fault or malfunction detection, or preventive maintenance services based on the condition of the machine; even fewer are using services for better energy management of machines and very few companies have developed predictive maintenance solutions. Manufacturing-as-a-Service (MaaS) is still unknown to two-thirds of companies, but it is beginning to spread around the world in the form of digital platforms that bring about a small revolution in the procurement of mechanical parts. In Europe alone, there are already five fully operational platforms.