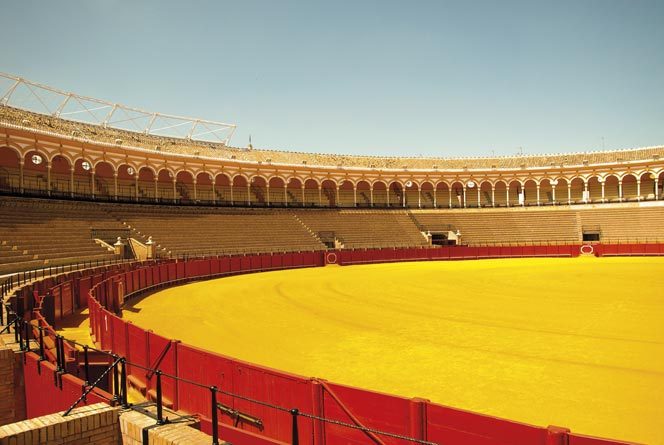

Spain Is Back in the Arena

Damaged significantly by the 2008 crisis, Spain is today one of the most dynamic economies in Europe, as well as the second largest European manufacturer – the eight in the world – in the automotive sector. Quite an important market for Italian producers as, according to Sace agency, Spain is expected to invest about 4.5 billion euro into Italian mechanical goods.

di Stefano Scuratti

In previous articles we have covered major nations of Eastern Europe, such as the Czech Republic, Romania, Slovakia and Slovenia. Several were the common factors that let us define the Central-Eastern Europe as a region that is experiencing quite a relevant industrial growth with business opportunities for Italian companies.

In this article, we want to claim an important concept: to highlight the opportunities for Italian companies on the basis of business volumes developed in the sector of mechanical goods in the last three years and analyze the projections for the next three years.

The Spanish economy then seems to be an important example. We have seen, in fact, that the Czech Republic accounts for approximately 1.3 billion euro of Italian mechanical goods with growth rates similar to the Asian markets. Spain will increase from 3.8 billion euro of mechanical goods purchased from Italy in 2016 to around 4.5 billion euro in 2019, according to Sace agency. Spain will therefore increase its imports of Italian mechanical engineering in the next three years by about 5.5% per year and will reach about 700 million euro of Italian mechanical goods to their production lines. companies should then focus right on these figures: a growth, and thus a new market, of 700 million euro amounts to over 50% of the Czech imports total value.

Dollar vs Percentage Growth

In simpler words, we should start thinking that the added value of a nation for exporting companies is not represented by the economy growth rates rather than by the business volume generated by the Italian companies in a specific sector, combined with the growth forecasts in percent in the given nation. It is interesting to understand the euro value that a given country is able to provide to Italian companies over the next three years. This concept (“Dollar vs Percentage Growth”) will guide future analysis even in identifying the “new markets”.

When analyzing the monetary value and growth as a percentage of the Italian mechanics in the various European countries, it is extremely interesting to notice that nations with the largest volume of turnover often develop the highest growth rates in the purchase of Italian mechanics.

It is therefore not correct to think that high growth opportunities are associated to low export volumes of Italian mechanical goods. The figures show exactly the opposite: wherever the Italian mechanical goods are already in the country and Italian companies have been able to show their skills both from a technological and commercial point of view, then there are interesting opportunities for future growth.

A dynamic economy after the crisis

Spain is a constitutional monarchy with a population of about 46.4 million inhabitants, a per capita GDP of about €22,641 and a gross domestic product of just over one billion euro. With a very low inflation rate and a debt to GDP ratio of about 100%, this economy has similar figures compared to Italy. During the financial crisis, the unemployment rate exceeded the levels of Italy and yet today Spain is growing by around 3%. It is indeed one of the most dynamic post-crisis economies, with an unemployment rate of about 11%.

It is good to remind that the Iberian peninsula, regardless of its GDP that makes it the 14th world economy, has always been a bridge to North Africa and especially a preferred partner for the development of business relations in Central and South America.

Most of the Spanish work force is in services (76%), industry (14%), construction (6%) and agriculture (4%). According to the National Statistics Institute, in 2015 the lower growth rate was in agriculture (0.5%) and services (2.9%), while the most significant data come precisely from the industry, grown by 3.6% and the construction sector, grown by 5.8%.

The second European manufacturer in the automotive sector

As regards to imports, the most important sectors for Spain are energy, which accounts for approximately 20%, chemicals (16%), automotive (13%) and consumer goods (12%). Spain’s top trading partners are Germany (13%), France (10.8%), China (8.6%) and Italy (6.3%). Italy ranks therefore among the main trading partners in the country especially as for chemical products, components and accessories for the automotive industry and steel products.

The main Italian investments in the country deal with the manufacturing of electrical machinery for 37%, wholesale for 15% and constructions for 7%.

The automotive sector is often used as a key to understanding a nation’s degree of automation. Spain is the second largest manufacturer in Europe and the eighth in the world. It boasts the primacy in Europe in industrial vehicles, with the presence of about 9 multinationals and 17 manufacturing plants in the country. An interesting data is that about 83% of the vehicles produced in Spain are sold abroad in about 100 nations and, even more interesting, Spain has about 1,000 small and medium-sized companies that make up the supply industry for the automotive sector.

This sector accounts for about 10% of the GDP and 20% of national exports, employing 300,000 people. In 2014, the Spanish industrial production in this sector grew by 11% to 2.4 million cars produced, which have grown further to 2.6 million in 2015. For 2017, industrial production is expected to reach 3 million vehicles produced thanks to 9 multinational companies currently investing about 10 billion in the country. Small and medium-sized suppliers represent a turnover of about 30 billion, 60% of which addressed abroad.

An important network for R&D

The technology level for Spanish manufacturers is quite high, with about 89 robots per 10,000 employees. The R&D in Spain is supported by an important network of clusters in the automotive sector and a by 34 technological parks. Among the major associations are ANFAC, for vehicle manufacturers, and SERNAUTO for the subcontracting sector.

The Spanish tax system is based on an income tax starting from 19% for levels under €12,500 up to 45% for levels higher than €60,000. The general tax rate applied to the tax base is 25% and the companies smaller than 10 million euro may apply a 15% rate up to €300,000. The VAT is 21% and is reduced to 10 and 4 on certain goods and services. Labour costs provide average salaries of €22,000 for workers, 21,000 for employees and 51,000 for managers.